It is important to understand that paying employees is a crucial part of running any business. Along with giving salary on time, it’s also required to log all such transactions in an efficient manner to avoid legal obligations. And that’s where payroll software comes in.

Using the right payroll software, you can get rid of excessive expenditures, while saving time and resources within the process. In this article, we are going to talk about some of the best payroll software that small businesses can use to boost efficiency and productivity.

Types of Payroll Software/Services

Primarily, there are three different types of payroll services that businesses can use. All the major operations revolve around these 3 different fields.

1. Time and Attendance Services

This service allows businesses to keep track of employees’ time and attendance. In fact, the software can even track their working hours, no. of sick days taken, absences, vacations, and more. It can attentively calculate the payment for every employee.

2. Tax Services

Even for small businesses, companies need to pay payroll taxes based on the wages paid to the employees. In fact, there are certain factors that companies need to take account of, often including complicated calculations. Using the right payroll tax services, this can be automatically taken care of.

3. Paycheck Services

While paying out wages to the employees, paycheck services can offer the right assistance. These services can efficiently pay the employees using their preferred mode of payment. Overall a pretty handy service to integrate within the business.

Also Read: 7 Best ERP Software You Can Use

Best Payroll Software You Can Use

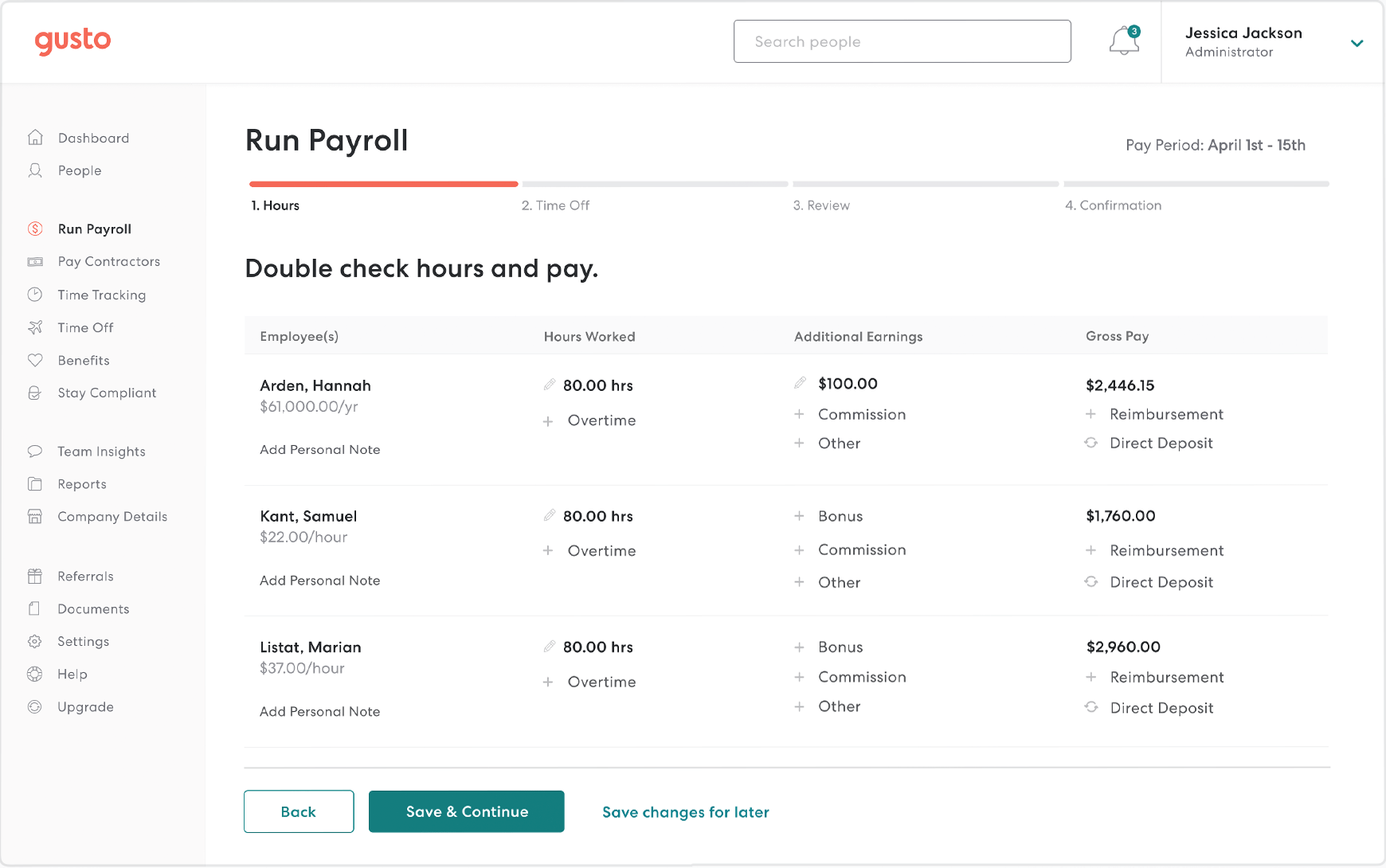

1. Gusto

Gusto is one of the favorite payroll software for any small business. Beautifully crafted, it comes with all the payroll and HR features any business would ever need. It allows businesses with automatic local, state as well as federal payroll tax filing.

Gusto comes with employee self-service portals for all their payment needs. With in-house insurance brokers, signing up for medical insurance allows the employer to pay for the premium only. These are some of the features that Gusto has included completely for free, with its competitors asking for additional charges.

Salient Features:

- Comes with automatic payroll administration

- A plethora of employee benefit options

- Various insurance options

- No extra charges for payroll tax filing or insurance add-ons

Pricing: Starts at 39 USD/month with 6 USD/payee/month

Get Gusto

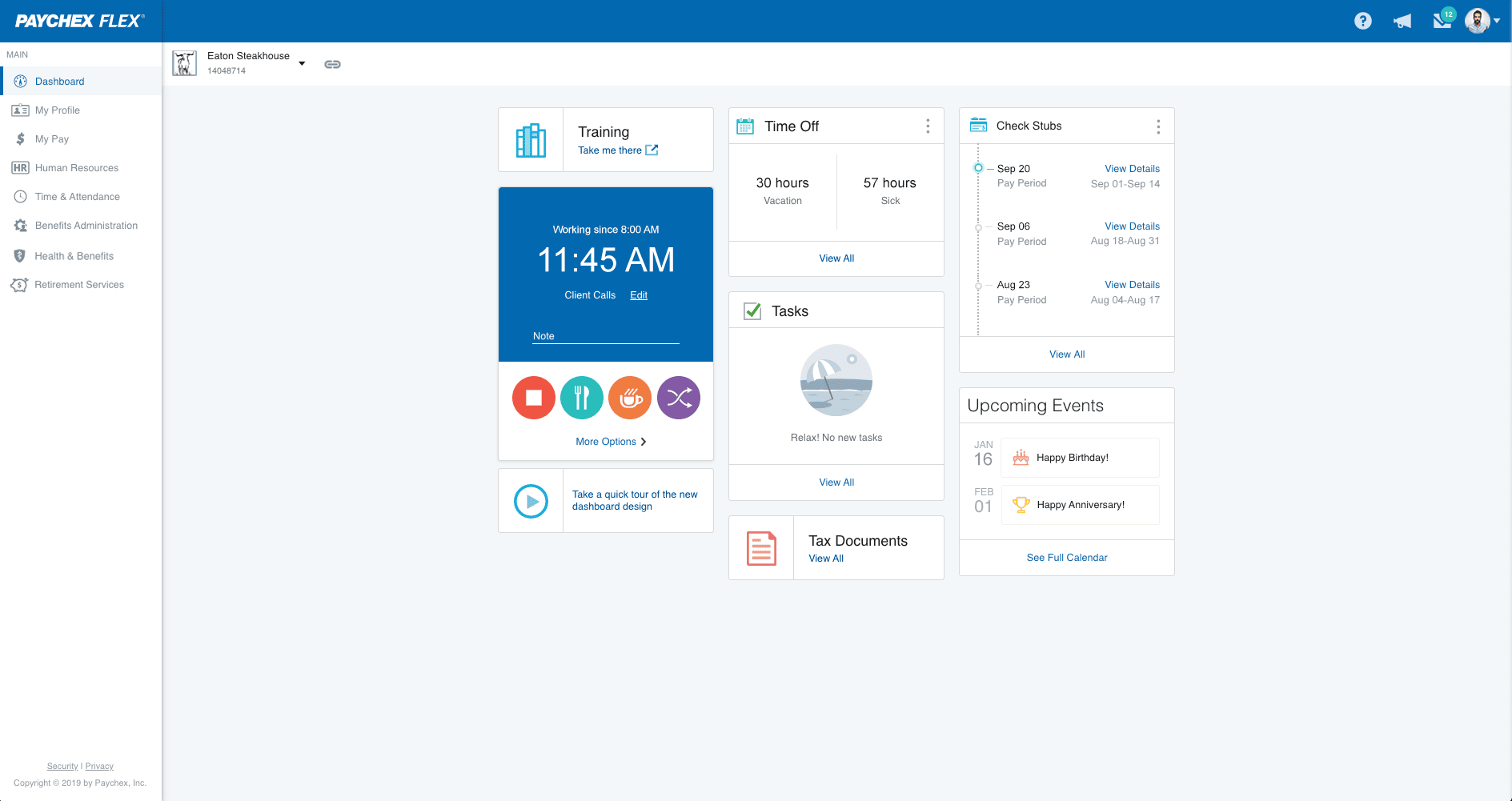

2. Paychex

If your small business seeks growth, Paychex is the perfect payroll software for you. It has Combined cloud-based payroll management and HR solutions for small to mid-size businesses. Talking about the features, the employer can get new-hire state reporting, tax filing along financial wellness programs.

One of the best features of Paychex is its customizability. Users can get additional features with extra charges. This modular approach makes Paychex the perfect solution for small businesses with constrained budgets. Some of its add-ons include accounting software integration, payroll tax administration as well as attendance software integration.

Salient Features:

- Offers automatic payroll tax administration

- Various payment options including direct deposit, debit card, and check

- Combined plan for HR and payroll services

- Comes with health insurance add-ons

Pricing: Starts at 39 USD/month with 5 USD/payee/month

Get Paychex

3. ADP

ADP has made one of the biggest names within the domain of payroll software. Even for small businesses that don’t require PEO, ADP offers dedicated HR services along with easy-to-use online payroll services. Even for the cheapest plan, ADP offers various HR components including employee onboarding, regular HR checkups as well as health care compliances.

Opt for some of the higher plans, and users get features such as employee background check-up, HR assistance as well as ZipRecruiter assistance. Overall, advantageous for businesses focusing on HR requirements.

Salient Features:

- Comes with automatic payroll administration

- Compensation for employees with health insurance add-on

- Offers assistance for both payroll and HR

- Offers a plethora of customizable plans

- Various payment options including direct deposit, debit card, and check

Pricing: Users need to contact for a quotation

Get ADP

4. Intuit QuickBooks

Intuit QuickBooks is one of the well-rounded payroll software that small businesses can use. In fact, opting for the core plan can be the best bank for the buck for small to medium-sized businesses. Users can easily add a 401(k) retirement plan along with health benefits for their employees within this plan.

One feature that sets Intuit QuickBooks apart from other services is its quick direct deposit. In fact, even on their core plan, QuickBooks offers next-day direct deposit. The payroll software can also be an ideal option for accountants with dedicated services just for that.

Salient Features:

- Comes with a dedicated activity dashboard

- Easier billing and invoicing

- Automatic billing functionality

- Expense and inventory tracking

- Payroll management

Pricing: 45 USD/month with 4 USD/payee/month

5. OnPay

OnPay is also one of the most beautifully crafted, easy-to-use payroll software for small businesses. One of the most intuitive features of OnPay includes its flexibility, due to which it can easily adapt to any business environment.

You can also get all the key payroll services completely for free while using OnPay. With the help of its in-house insurance team, OnPay makes paying premiums extremely seamless. The only downside of using OnPay is its lack of any comprehensive HR service. Otherwise, it is a pretty intuitive software for payroll.

Salient Features:

- Offers automatic payroll tax administration

- Comes with affordable pricing options

- Easy instance add-ons

- Great employee benefits

Pricing: Starts at 36 USD/month with 5 USD/payee/month

Get OnPay

Also Read: 7 Best Accounting Software You Can Use

The Bottom Line

That’s it for this article. Even the traditional bookkeeping of doing these things works fine for you, we would recommend you to try software. Based on your requirements, way you can choose among the best payroll software mentioned above. It can save a lot of time, hassle, and above all, significantly reduce the risks that come from managing payrolls.

For what it’s worth, the best small business software I’ve ever used combines tax and payroll tools. I used AMS for years, which starts with a W-2 and 1099 filer. I’ve never had an easier time running accounting.